Our Mission

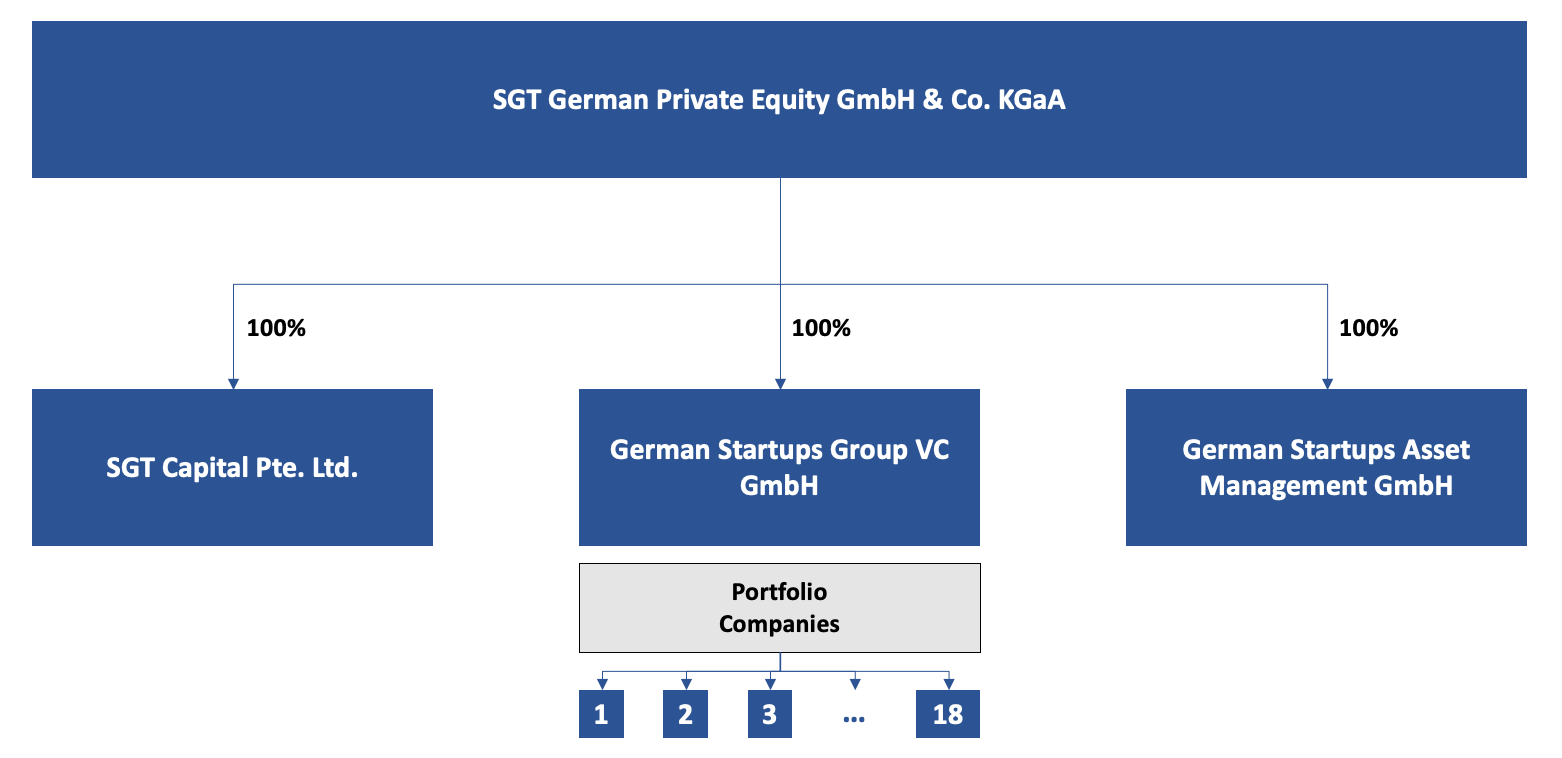

SGT German Private Equity is a listed investment holding with registered office in Frankfurt/Main.

From mid-March 2024, we will focus entirely on artificial intelligence and change its name to German AI Group. We will report details in the second quarter of 2024.

From its origin as a leading German venture capital provider under the German Startups Group brand SGT German Private Equity holds a heritage portfolio of minority stakes in some promising German Tech Startups.

MANAGEMENT

Christoph GerlingerCEO

Christoph is CEO of SGT German Private Equity GmbH & Co. KGaA, which he founded in 2012 which until October 2020 operated under the brand of German Startups Group and was a leading German VC provider in Germany with investments in start-ups such as Delivery Hero, Chrono 24, MisterSpex and Scalable Capital.

In 2020, German Startups Group merged with SGT Capital Pte. Ltd. and became SGT German Private Equity GmbH & Co. KGaA. Christoph has gained over 20 years of management experience in the Internet industry, in which he has founded and brought to life a number of businesses. Amongst these is Frogster Interactive Pictures AG, founded in 2005, which he took public and managed as CEO for seven years. Prior to that, he was Head of Germany for Infogrames/Atari and CFO of CDV, which he took public as well.

Christoph was named one of the 50 most interesting founders by the German business magazine Wirtschaftswoche, was appointed external expert of the network 'Digitalization' and member of the digital commission by the federal board of the CDU. He holds a graduate degree in Business Administration from Johann Wolfgang Goethe-University Frankfurt and is a graduate of the artificial intelligence executive program of MIT Sloan School / CSAIL, Cambridge. He also is alumnus of Singularity University’s 'Executive Program 2017' and 'Future of AI Program 2024' in Silicon Valley, USA. Christoph occasionally releases own articles and gives interviews in various publications.

Supervisory Board

Lawyer

Founder and Managing Director of a corporate finance advisory and investment company

More than 20 years on the board of directors and head of investment management at various investment companies

Over 30 years of experience as a supervisory board member in listed companies

Capital Markets Expert

Long-standing seats on various supervisory boards, 35 years of banking experience in leading positions

More than 10 years as CEO of AXG Investment Bank and Head of Corporate Finance Commerzbank

Significantly involved in more than 40 IPOs

Strategic consultant with focus on public affairs, public relations and private equity for more than 20 years

Private equity expert

Board Member of several domestic and international companies

Former Swiss Ambassador to the Federal Republic of Germany

Lawyer

Fund and capital markets expert

Co-founder and supervisory board chairman of Shareholder Value Management AG, an owner-managed investment specialist with focus on value stocks, based in Frankfurt

Roughly 20 years of expertise as executive board member and fund manager

Accredited advocate

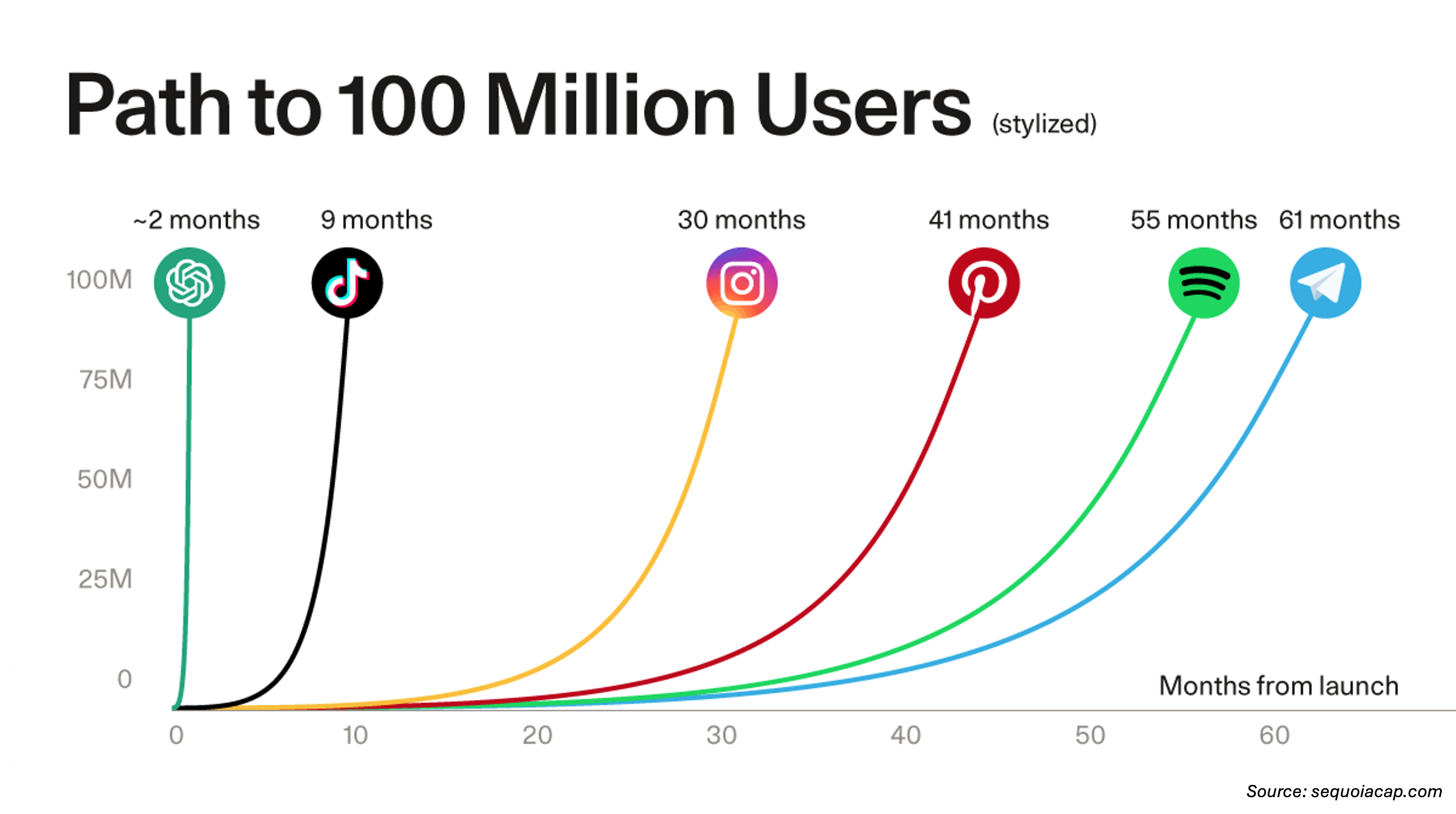

Artificial Intelligence

New business segment to be revealed soon.

„AI will change our world.”

Bill Gates

“This is going to be, I think, one of the biggest industries that we will ever see.

It’s bigger than the automobile and the mobile phone combined.”

Elon Musk

“AI ist more significant than the invention of fire.”

Sundar Pichai

“Yes, there was internet. Then mobile. And now, there is genAI.”

Anand Sanwal

“Generative AI has the potential to revolutionize nearly every industry, including healthcare, finance and education.”

Sam Altman

“I’m convinced that AI is the single most important technology we’ve ever created –

and one that has the greatest potential to uplift humanity”

Peter Diamandis